Global Trends Shaping the Future of Bag Making Machines in 2025

The bag making machine industry is experiencing significant evolution as manufacturers around the world adopt advanced technologies to meet growing production demands. From automation to sustainable practices, global trends are reshaping how woven polypropylene (PP) and laminated bags are produced. Understanding these trends is crucial for manufacturers, investors, and industry stakeholders aiming to remain competitive.

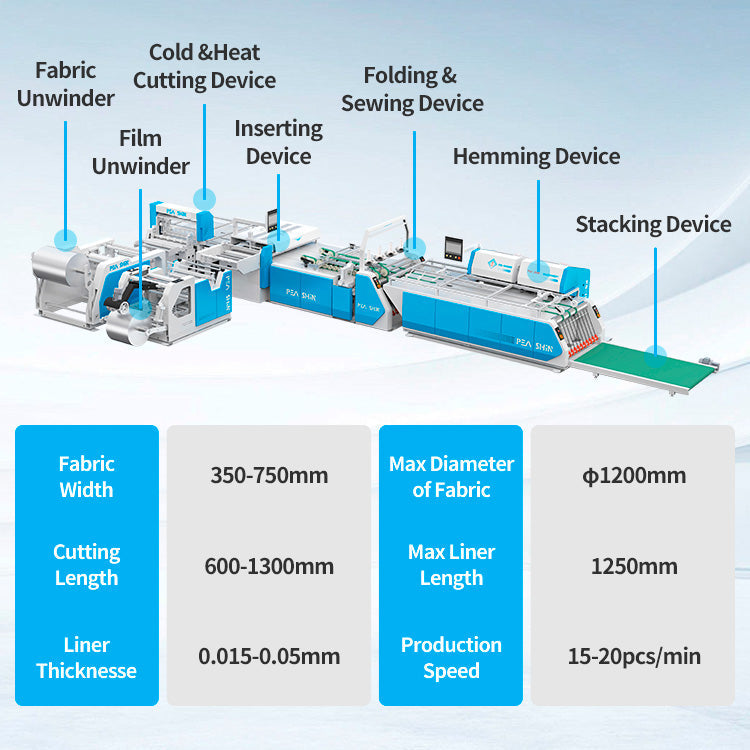

One of the most prominent trends is automation and digital integration. Modern bag making machines increasingly incorporate servo motors, PLC systems, and touchscreen interfaces, allowing precise control over cutting, sealing, and stacking processes. Automated systems reduce labor dependency, improve consistency, and enable rapid changeovers for different bag sizes or materials. Factories that embrace automation report higher throughput, lower waste, and reduced downtime.

Sustainability and eco-friendly production have become central to the industry. Companies are prioritizing machines that can handle recycled polypropylene, biodegradable films, or laminated multi-layer bags with minimal energy consumption. Energy-efficient motors, intelligent idle modes, and waste reduction mechanisms are now key selling points for bag making equipment. As environmental regulations tighten globally, sustainable solutions are no longer optional—they are a competitive advantage.

Market diversification also drives innovation. Manufacturers are no longer limited to producing standard flat bags; demand for valve bags, block-bottom bags, jumbo FIBCs, and customized shopping bags is growing rapidly. Machines with flexible configurations and modular add-ons allow factories to adapt quickly to market needs, catering to industries like agriculture, food, chemicals, and retail packaging.

Global supply chain dynamics are influencing purchasing decisions. Rising material costs, import/export regulations, and regional manufacturing capacities make it essential for factories to choose equipment that is reliable, maintainable, and globally supported. Brands offering fast spare parts delivery and technical support across regions are increasingly favored, as downtime directly impacts profitability.

Digital monitoring and predictive maintenance are emerging as critical differentiators. Sensors and software now track motor loads, sealing temperatures, and production speeds in real time. This allows maintenance teams to prevent failures before they occur, ensuring continuous operation. Predictive maintenance reduces operational risk, minimizes production losses, and extends the lifespan of expensive machinery.

High-speed production capabilities remain a major selling point. Modern lines can produce hundreds to thousands of bags per minute without compromising quality. Advanced sealing technology, precise cutting systems, and synchronized stacking mechanisms improve efficiency, especially for large-volume industrial applications like fertilizer, cement, and chemical packaging.

Customization and integration are also key considerations. Manufacturers increasingly demand machines that integrate printing, lamination, perforation, and handle insertion without requiring separate lines. Integrated solutions reduce floor space, labor costs, and workflow complexity. Modular designs make it easier to upgrade machines as technology advances, offering long-term flexibility.

Finally, regional and global market growth plays a role in shaping technology adoption. Asia-Pacific, Africa, and Latin America are seeing rapid expansion in the packaged goods sector, increasing demand for mid-range and high-end bag making machines. Factories in these regions seek a balance between affordability, automation, and support, driving competition among machine suppliers.

In conclusion, the bag making machine industry is evolving rapidly. Automation, sustainability, flexibility, predictive maintenance, and global support are the dominant trends influencing purchase decisions and factory upgrades. Manufacturers that align with these trends are likely to gain a competitive advantage in 2025 and beyond, delivering high-quality packaging solutions efficiently and responsibly.